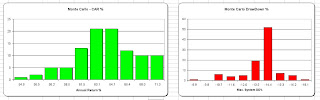

Compound Annual Return and Drawdown Monte Carlo Results (Backtest)

Compound Annual Return and Drawdown Monte Carlo Results (Backtest) Returns per year vs Index (in brackets)

Returns per year vs Index (in brackets)1. Trades long only ASX stocks based on weekly charts

2. Identifies bullish market conditions before entering any trade

3. The entry has three conditions - based on price , volume and volatility. The conditions are surprisngly simple and not curve fitted.

4. The exit has three conditions - trailing volatility stop, momentum stop and market condition stop.

I have attached some metrics of the system using Amiboker backtesting over the XAO index constituents for 2000-2008. Highlights are a win:loss ratio of over 4 and a winning % of > 50%.

It should be noted that the Aussie market has been through a once in a generation bull market and so returns during 2004-2007 will flatter most systems. A big strength of this system is that it will aggressively buy in bull markets or bear marker rallies , exit the market quickly if needed and sit idle in bear markets like 2007 -2009 and live to fight another day.

No allowance has been made for slippage. For very short term systems this can destroy results, but for this style of system it is not as critical.

No comments:

Post a Comment