Tuesday, December 1, 2009

Friday, October 30, 2009

Monday, October 19, 2009

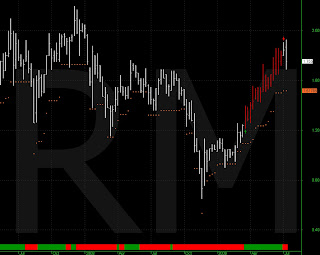

HZN Trade

HZN is a current open trade. Prices are bumping up against some significant resistance at 34c. Huge volume went through about 8 weeks ago. I like the look of it - but I also liked the look of BLY.

HZN is a current open trade. Prices are bumping up against some significant resistance at 34c. Huge volume went through about 8 weeks ago. I like the look of it - but I also liked the look of BLY.Saturday, September 19, 2009

Statistics SMSF July 09 - Aug09

Monday, September 7, 2009

BLY Exit - C'est la vie

C'est la vie is a french saying meaning "such is life". A fuller meaning is - life is harsh, get used to it. Or in my case, the minute I start to get comfortable with a trade it all turns to ****.

C'est la vie is a french saying meaning "such is life". A fuller meaning is - life is harsh, get used to it. Or in my case, the minute I start to get comfortable with a trade it all turns to ****.What happened ?- basically the directors decided to dilute the value of the company by issuing shares at 27cents. I did say " anything can happen" which proved prophetic.

On to the next trade .......

Sunday, August 16, 2009

BLY Trade

BLY (Boart Longyear)is a current open trade in the SMSF portfolio. I really like the look of this trade. Notice how after my buy signal prices pulled back for 4 or 5 weeks but volume decreased. As prices have moved up, volume has picked up. I also like the large saucer bottom prices have made over the last 10 months or so. Open profit of 45% is good, but it is nice to get a few 100% gains as these are the ones that make for a good year. Having said all that, I know anything can happen!

BLY (Boart Longyear)is a current open trade in the SMSF portfolio. I really like the look of this trade. Notice how after my buy signal prices pulled back for 4 or 5 weeks but volume decreased. As prices have moved up, volume has picked up. I also like the large saucer bottom prices have made over the last 10 months or so. Open profit of 45% is good, but it is nice to get a few 100% gains as these are the ones that make for a good year. Having said all that, I know anything can happen!Fundamentally, the reason for the price rising appears to be the fact that Borat(I mean Boart) has secured funding from the banks and won't actually go broke. Small comfort if you bought in at $2.50+ as it currently is trading at 44 cents.

I am not going to post any performance figures yet, as the SMSF portfolio is too new. Total 8 open positions, nothing stopped out since portfolio started in early June.

Sunday, August 9, 2009

Why do my trading systems work?

Sunday, July 12, 2009

MRM Exit

Tuesday, June 23, 2009

Trading Psychology

Tricks of the trade lead us all to feel rather than think

Marcus PadleyJune 20, 2009

MOST traders lose money. If you read some of the literature on the subject, the suggestion is that 60 per cent-90 per cent of traders lose money, depending on their level of leverage.

For retail investors, trading foreign exchange is apparently the biggest killer, followed by futures, options, CFDs (contracts for difference) and margin lending on shares. In one of these groups only 2 per cent make money and in another the average life span of a trader is six to eight weeks.

Why do so many people lose at trading? The answer is that they are humans not machines. Most traders do not think clearly and, faced with losses, gains, luck and indecision, they begin to function emotionally instead of mechanically. It is this weakness the studied professional trader takes advantage of.

This is what behavioural finance is all about. Over a large population and a significant period of time seemingly unpredictable emotions repeat, become predictable and can be exploited. For traders who understand this and trade against it, it is like owning the "zero" on the roulette wheel. An edge that will manifest itself over time.

So how do you stop other people exploiting your emotions? You change. But before you can do that the first step is to identify the common behaviour patterns that lose you money. Here's a list of some of the more common ones. In financial and social theory some of these are called cognitive biases, erroneous rules of thumb or common errors of judgement. In trading there are many. You might recognise a few of your own:

■Emotional bias — the tendency to believe the things that make you feel good and to disregard things that make you feel bad. In trading terms this means ignoring the bad news and focusing on the good news. It's called losing objectivity. You don't recognise when things go wrong because you don't want to.

■Expectation bias — the tendency to believe in things that you expect. In financial terms this means not bothering to analyse, test, measure or doubt the conclusion you expect or hope for. It is also known as the law of small numbers. Believing in something with little real evidence.

■The disposition effect — the tendency to cut your profits and let your losses run. The complete opposite of what a trader should be doing. Making small profits and big losses is a recipe for losses.

■Loss aversion — the tendency to value the avoidance of loss more highly than the making of gain. Losses affect you more than gains. Because of this you become more emotional when making losses, the point at which a rational decision would save you the most money.

■The sunk cost fallacy — this is the tendency for our decision making to be influenced by the size of the loss we have already incurred. The bigger the loss the more likely we are to persist with a losing trade rather than to take the rational decision and cut to a more profitable trade. The size of your loss has no effect on the future share price but a huge effect on your ability to make the right decision.

■The bandwagon effect — the tendency to think it must be right because everyone else is doing it. A thought process guaranteed to get you in when it's obvious and get you out when it's obvious. Put another way, it has you buying at the top and selling at the bottom.

■Past price fixation — this is the tendency to avoid prudent trading decisions by anchoring your thought process to prices that no longer exist. "I'll sell it if it gets back to $4." "I'll buy it if it gets down to $4 again." We are all guilty.

In trend-following trading, if the price goes up you don't sell you buy and if it goes down you don't buy you sell. The old high has gone. The old low has gone. Don't wait for them to come back to do the wrong thing.

It's not easy to be unemotional when trading but that's how we're all wired. To move from the losing majority to the winning minority we will all just have to unplug and reconfigure.

Marcus Padley is a stockbroker with Patersons Securities and the author of the daily sharemarket newsletter Marcus Today.

www.marcustoday.com.au

Saturday, June 13, 2009

MRM still open

The MRM trade is still open and looking pretty good - prices moved past some significant resistance levels from back in October. However, I really don't worry about things like that. I know that every trade has about a 50% chance of being profitable. Notice also that the trailing stop is still only just above the actually entry price.

I have been mainly out of the market for about 18 months now due to other uses of my capital, and it is a bit frustrating to watch such a great bear market rally unfold. I have only just started to trade again with my small SMSF portfolio, but bigger things will have to wait for later in the year.

Monday, May 18, 2009

Constellation

Constellation was developed using Amibroker software in about 2004 . I would descibe it as a medium to long term trend following system. The basic underlying components of the system are -

1. Trades long only ASX stocks based on weekly charts.

This system has the same stop as Supernova. No allowance has been made for slippage. For very short term systems this can destroy results, but for this style of system it is not as critical.

Monday, May 11, 2009

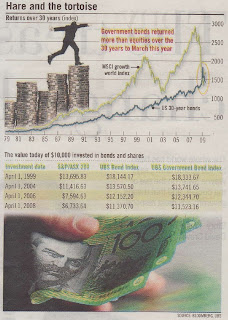

Why Trade Part II ?

I was reading the Australian Financial Review last weekend and came across an article on the return of Bonds v Shares. What a shocker - turns the conventional wisdom almost totally on it's head of risk v return. There has been no payoff for taking excess risk in Shares if you are a managed fund or index investor.

I don't like the lack of control in these forms of investment and the above graph reinforces my beliefs.

Saturday, May 9, 2009

Meteor

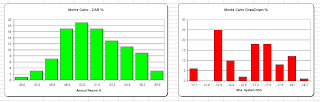

Compound Annual Return and Drawdown Monte Carlo Backtest Results

Compound Annual Return and Drawdown Monte Carlo Backtest Results Returns per year vs Index(in brackets)

Returns per year vs Index(in brackets)Meteor was developed using Amibroker software in about 2005 . I would descibe it as a medium to long term trend following system. The basic underlying components of the system are -

1. Trades long only ASX stocks based on weekly charts

2. Identifies bullish market conditions before entering any trade

3. The entry has three conditions - based on price , volume and volatility The conditions are surprisingly simple and not curve fitted.

4. The exit has two conditions - trailing volatility stop and momentum stop.

I have attached some metrics of the system using Amiboker backtesting over the XAO index constituents for 2000-2008. Highlights are a win:loss ratio of over 4 and a winning % of > 50%.

No allowance has been made for slippage. For very short term systems this can destroy results, but for this style of system it is not as critical.

Tuesday, May 5, 2009

Chart Title setup

Amibroker is extremely powerful charting and back-testing software.

I have set up the Chart Title display to help in position sizing. I simply need to right click on the chart and select the parameters window to change the trade size.

Supernova

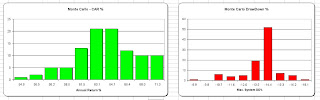

Compound Annual Return and Drawdown Monte Carlo Results (Backtest)

Compound Annual Return and Drawdown Monte Carlo Results (Backtest) Returns per year vs Index (in brackets)

Returns per year vs Index (in brackets)1. Trades long only ASX stocks based on weekly charts

2. Identifies bullish market conditions before entering any trade

3. The entry has three conditions - based on price , volume and volatility. The conditions are surprisngly simple and not curve fitted.

4. The exit has three conditions - trailing volatility stop, momentum stop and market condition stop.

I have attached some metrics of the system using Amiboker backtesting over the XAO index constituents for 2000-2008. Highlights are a win:loss ratio of over 4 and a winning % of > 50%.

It should be noted that the Aussie market has been through a once in a generation bull market and so returns during 2004-2007 will flatter most systems. A big strength of this system is that it will aggressively buy in bull markets or bear marker rallies , exit the market quickly if needed and sit idle in bear markets like 2007 -2009 and live to fight another day.

No allowance has been made for slippage. For very short term systems this can destroy results, but for this style of system it is not as critical.Sunday, April 26, 2009

MRM Trade

Why Trade?

Saturday, April 25, 2009

The purpose of my blog is firstly to create a record of my trading history. I have spent many years and countless hours studying and researching the markets. I have viewed the industry from the perspective of a trustee of a public Superannuation Fund, sitting around a board room in suit and tie. I have geared 100% into the market using managed funds at the top of the market in 2000. I have tried separately managed futures accounts, options trading, trading newsletter recommendations, buy and hold newsletters , quant stock investing and managed day trading accounts on the US markets. There is virtually nothing I haven't tried.

It's been a very good few months - not too hard to make money at the moment. Market is due for a retracement. I have included my Open Positions for interest. Nothing sold in September.

It's been a very good few months - not too hard to make money at the moment. Market is due for a retracement. I have included my Open Positions for interest. Nothing sold in September.